Cost Of Control Is Also Known As Capital Profit . at its core, cost control is a multifaceted financial management strategy aimed at curbing expenditures within an organization. It’s calculated by a business’s accounting. Cost of capital reflects a company’s risk level, with higher risk. Before a business can turn a profit, it must at least generate. cost of capital is the minimum rate of return that a business must earn before generating value. cost control is the practice of identifying and reducing business expenses to increase profits, and it starts with the budgeting process. cost of capital is the minimum rate of return or profit a company must earn before generating value.

from efinancemanagement.com

Cost of capital reflects a company’s risk level, with higher risk. at its core, cost control is a multifaceted financial management strategy aimed at curbing expenditures within an organization. Before a business can turn a profit, it must at least generate. cost control is the practice of identifying and reducing business expenses to increase profits, and it starts with the budgeting process. cost of capital is the minimum rate of return that a business must earn before generating value. It’s calculated by a business’s accounting. cost of capital is the minimum rate of return or profit a company must earn before generating value.

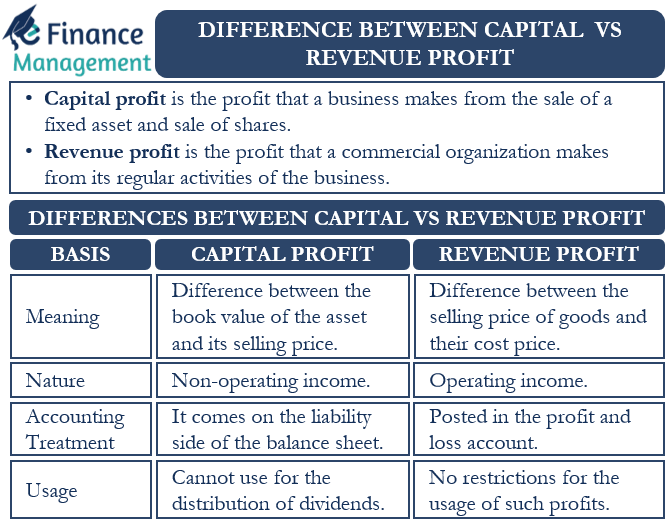

Capital Profit and Revenue Profit Meaning, Differences, Example eFM

Cost Of Control Is Also Known As Capital Profit It’s calculated by a business’s accounting. cost of capital is the minimum rate of return or profit a company must earn before generating value. Before a business can turn a profit, it must at least generate. cost control is the practice of identifying and reducing business expenses to increase profits, and it starts with the budgeting process. It’s calculated by a business’s accounting. at its core, cost control is a multifaceted financial management strategy aimed at curbing expenditures within an organization. cost of capital is the minimum rate of return that a business must earn before generating value. Cost of capital reflects a company’s risk level, with higher risk.

From koniukhchaslau.com

What is profit capitalization and its advantages Cost Of Control Is Also Known As Capital Profit at its core, cost control is a multifaceted financial management strategy aimed at curbing expenditures within an organization. cost of capital is the minimum rate of return that a business must earn before generating value. Cost of capital reflects a company’s risk level, with higher risk. cost of capital is the minimum rate of return or profit. Cost Of Control Is Also Known As Capital Profit.

From themumpreneurshow.com

Cost Control Vs Cost Optimization Get To Know Which Is Right For You Cost Of Control Is Also Known As Capital Profit cost of capital is the minimum rate of return that a business must earn before generating value. It’s calculated by a business’s accounting. Before a business can turn a profit, it must at least generate. Cost of capital reflects a company’s risk level, with higher risk. cost of capital is the minimum rate of return or profit a. Cost Of Control Is Also Known As Capital Profit.

From www.geeksforgeeks.org

Share Capital Meaning, Kinds, and Presentation of Share Capital in Cost Of Control Is Also Known As Capital Profit cost of capital is the minimum rate of return that a business must earn before generating value. at its core, cost control is a multifaceted financial management strategy aimed at curbing expenditures within an organization. cost of capital is the minimum rate of return or profit a company must earn before generating value. Cost of capital reflects. Cost Of Control Is Also Known As Capital Profit.

From googlesir.com

What are Capital Profits & Revenue Profits (With Examples) Cost Of Control Is Also Known As Capital Profit cost control is the practice of identifying and reducing business expenses to increase profits, and it starts with the budgeting process. It’s calculated by a business’s accounting. Cost of capital reflects a company’s risk level, with higher risk. cost of capital is the minimum rate of return or profit a company must earn before generating value. at. Cost Of Control Is Also Known As Capital Profit.

From www.economicshelp.org

Diagrams of Cost Curves Economics Help Cost Of Control Is Also Known As Capital Profit at its core, cost control is a multifaceted financial management strategy aimed at curbing expenditures within an organization. cost of capital is the minimum rate of return or profit a company must earn before generating value. Cost of capital reflects a company’s risk level, with higher risk. Before a business can turn a profit, it must at least. Cost Of Control Is Also Known As Capital Profit.

From goaccounting.blogspot.com

GO Accounting Capital and Revenue Transactions Cost Of Control Is Also Known As Capital Profit Cost of capital reflects a company’s risk level, with higher risk. cost of capital is the minimum rate of return that a business must earn before generating value. It’s calculated by a business’s accounting. cost of capital is the minimum rate of return or profit a company must earn before generating value. at its core, cost control. Cost Of Control Is Also Known As Capital Profit.

From www.awesomefintech.com

Capitalization Of Profits AwesomeFinTech Blog Cost Of Control Is Also Known As Capital Profit It’s calculated by a business’s accounting. Before a business can turn a profit, it must at least generate. at its core, cost control is a multifaceted financial management strategy aimed at curbing expenditures within an organization. cost of capital is the minimum rate of return that a business must earn before generating value. cost control is the. Cost Of Control Is Also Known As Capital Profit.

From www.fool.com

A Small Business Guide to Calculating Net Working Capital Cost Of Control Is Also Known As Capital Profit Before a business can turn a profit, it must at least generate. at its core, cost control is a multifaceted financial management strategy aimed at curbing expenditures within an organization. cost control is the practice of identifying and reducing business expenses to increase profits, and it starts with the budgeting process. cost of capital is the minimum. Cost Of Control Is Also Known As Capital Profit.

From www.investopedia.com

What Is Capitalization? Cost Of Control Is Also Known As Capital Profit at its core, cost control is a multifaceted financial management strategy aimed at curbing expenditures within an organization. Cost of capital reflects a company’s risk level, with higher risk. cost of capital is the minimum rate of return that a business must earn before generating value. It’s calculated by a business’s accounting. cost control is the practice. Cost Of Control Is Also Known As Capital Profit.

From helpfulprofessor.com

10 Implicit Costs Examples (2024) Cost Of Control Is Also Known As Capital Profit It’s calculated by a business’s accounting. cost control is the practice of identifying and reducing business expenses to increase profits, and it starts with the budgeting process. cost of capital is the minimum rate of return or profit a company must earn before generating value. at its core, cost control is a multifaceted financial management strategy aimed. Cost Of Control Is Also Known As Capital Profit.

From greenbayhotelstoday.com

Profitability Ratios What They Are, Common Types, and How Businesses Cost Of Control Is Also Known As Capital Profit It’s calculated by a business’s accounting. Before a business can turn a profit, it must at least generate. cost of capital is the minimum rate of return or profit a company must earn before generating value. cost of capital is the minimum rate of return that a business must earn before generating value. cost control is the. Cost Of Control Is Also Known As Capital Profit.

From www.slideserve.com

PPT Chapter 3 Cost/Volume/Profit Relationships PowerPoint Cost Of Control Is Also Known As Capital Profit It’s calculated by a business’s accounting. cost of capital is the minimum rate of return that a business must earn before generating value. at its core, cost control is a multifaceted financial management strategy aimed at curbing expenditures within an organization. Before a business can turn a profit, it must at least generate. Cost of capital reflects a. Cost Of Control Is Also Known As Capital Profit.

From asana.com

Cost Control Monitor Project Spending & Profitability [2022] • Asana Cost Of Control Is Also Known As Capital Profit cost of capital is the minimum rate of return that a business must earn before generating value. cost control is the practice of identifying and reducing business expenses to increase profits, and it starts with the budgeting process. Cost of capital reflects a company’s risk level, with higher risk. cost of capital is the minimum rate of. Cost Of Control Is Also Known As Capital Profit.

From courses.lumenlearning.com

Capitalization versus Expensing Financial Accounting Cost Of Control Is Also Known As Capital Profit Cost of capital reflects a company’s risk level, with higher risk. cost of capital is the minimum rate of return that a business must earn before generating value. at its core, cost control is a multifaceted financial management strategy aimed at curbing expenditures within an organization. cost of capital is the minimum rate of return or profit. Cost Of Control Is Also Known As Capital Profit.

From www.tutor2u.net

Return on Capital Employed tutor2u Cost Of Control Is Also Known As Capital Profit It’s calculated by a business’s accounting. Before a business can turn a profit, it must at least generate. at its core, cost control is a multifaceted financial management strategy aimed at curbing expenditures within an organization. cost of capital is the minimum rate of return that a business must earn before generating value. cost control is the. Cost Of Control Is Also Known As Capital Profit.

From www.slideserve.com

PPT Basic Corporate Finance 220897 Lecture 10 Cost of Capital Cost Of Control Is Also Known As Capital Profit at its core, cost control is a multifaceted financial management strategy aimed at curbing expenditures within an organization. cost control is the practice of identifying and reducing business expenses to increase profits, and it starts with the budgeting process. cost of capital is the minimum rate of return or profit a company must earn before generating value.. Cost Of Control Is Also Known As Capital Profit.

From efinancemanagement.com

Capital Profit and Revenue Profit Meaning, Differences, Example eFM Cost Of Control Is Also Known As Capital Profit cost of capital is the minimum rate of return or profit a company must earn before generating value. It’s calculated by a business’s accounting. at its core, cost control is a multifaceted financial management strategy aimed at curbing expenditures within an organization. Cost of capital reflects a company’s risk level, with higher risk. Before a business can turn. Cost Of Control Is Also Known As Capital Profit.

From www.youtube.com

Capital Profit vs Revenue Profit with examplesIntroduction to capital Cost Of Control Is Also Known As Capital Profit at its core, cost control is a multifaceted financial management strategy aimed at curbing expenditures within an organization. It’s calculated by a business’s accounting. cost of capital is the minimum rate of return that a business must earn before generating value. cost control is the practice of identifying and reducing business expenses to increase profits, and it. Cost Of Control Is Also Known As Capital Profit.